Learn Tally Prime with GST

Master Tally Prime with GST – get Job Ready with CMIT Institute

Offline / Online/ Hybrid

Your comprehensive guide on Basic to Advanced Computerized Accounting, GST with TallyPrime. Tally has an evolving market at the domestic, national, as well as international level. Account management is considered one of the most crucial areas of business operations, and plays an evident role in the tremendous growth of the organization.

Quick Enquiry

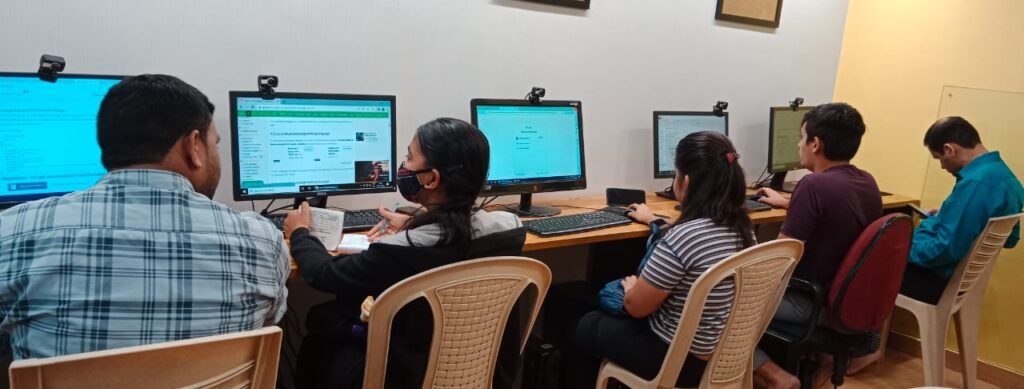

Gallery

Students Reviews

Trustindex verifies that the original source of the review is Google. I've recently completed diploma course in CMIT computer institute , , mulund east and it was really helpful. The course taught me a lot skills in computer. The mentors here are very helpful and understandable.There teaching skills are very goodTrustindex verifies that the original source of the review is Google. As being a cmit student all the faculty has helped me to experience a good journey towards the Microsoft World and Tally prime which has enhanced my technical journey.Trustindex verifies that the original source of the review is Google. The faculty is very great and supportive the teachers are so good in teaching and plus the doubts are always cleared thoroughlyTrustindex verifies that the original source of the review is Google. A very good experience overall. The faculties try their best to make us understand the concept.Trustindex verifies that the original source of the review is Google. The institute is good all teaching staff in nice they teach us till we don't understand the concept of the topic Thank you!!Trustindex verifies that the original source of the review is Google. Overall experience was good, the Excel teacher teaching style was good, But I would have loved if it was only one group teaching for full 1 hour. But overall good value addition and good value for money. ThankyouTrustindex verifies that the original source of the review is Google. I recently completed the Advanced Excel course in CMIT Computer Institute, Mulund East, and it was really helpful! The course taught me a lot of new Excel skills that I can now use for work or personal projects.Trustindex verifies that the original source of the review is Google. It was an amazing experience here learning at CMIT , all my doubts were cleared and explained throughly !Trustindex verifies that the original source of the review is Google. Very good

Why Learn Tally Prime ?

To acquire the basics of accounting and accounting standards.

To wrap your head around Tally and use Tally in accounting.

To know all about Tally ERP 9 and Tally Prime and their functionality.

To grow your knowledge of accounting basics like debits and credits to further post entries confidently.

Tally Prime Level Wise Content

- BASIC TALLY

- ADVANCE TALLY

- GOODS & SERVICES TAX (GST)

- Introduction To Accounting

- Important Concepts And Definition –Like, Accounting, Capital, Assets,

And Liabilities Etc. - Types Of Accounts And Rule Of Accounts

- Accounting Vouchers

- Introduction To Tally

- Company Create, Alter, Shut Etc.

- Ledger Creation, Voucher Entry

- Trial Balance, P & L Account, Balance Sheet

- Bill Wise Details

- Budget

- BRS, Cheque Printing

- Cost Centre

- Inventory Master And Invoice Entry

- Pure Inventory Vouchers

- TDS

- Interest Calculation

- Various Reports

- Payroll

- POS

- Bill Of Materials

- Job Costing

- Job Order Processing

- Multicurrency

- Multilanguage

- Reorder Level

- Price Levels

- Batch Wise Details

- Zero Value Entry

- Actual And Bill Quantity

- Scenario

- Security Control

- Introduction to GST. What Is CGST, SGST, IGST?

- Activation Of GST

- Creating Master Of GST

- Creating Tax Ledgers

- Voucher Entry

- Recording GST Sales & Printing Invoices

- GST Reverse Charge

- GST Advance Receipt And Payment

- Recording GST Local & Interstate Purchase

- GST Online Returns

- GST Reports

- GST SEZ, Nil Rated, Exempt Sales ,LUT Bond ,

- GST On Services

- Purchase From Composite Dealer

- GST With TDS

- GST E-Way Bill

- GST Online Form Return Demo

Who Should Learn Tally Prime with GST ?

Future of Tally

- Generally speaking, Tally has an evolving market at the domestic, national, as well as international level. Account management is considered one of the most crucial areas of business operations, and plays an evident role in the tremendous growth of the organization.

- Accounting has been at the heart of every company, business, and enterprise since time immemorial. In the years to come, accounting has become an inevitable part of every company to maintain records, bookkeeping, payment management, and other accounts and finance-related tasks.

- Tally Advanced course imbues the industry- recognized expertise in the professionals and newbies, giving them an edge over similar people in the market. With that being the case, professional expertise in accounting software leads to expansive growth and progress in careers better than others.

- The majority of businesses have progressively come to the realization that cutting-edge methods and tools produce profitable accounting solutions. Accounting has undergone a paradigm shift toward enhanced software training, making it a more delicate and precise function. As a result, large corporations are ready to pay extra for skilled accountants who have received advanced Tally training.

- Accounting and Tally go hand-in-hand and there is a potential for immense growth in this explicable bond. Businesses are centred around accounting and finance, and there are absolutely no chances of enterprises and businesses waning in the future. As long as industries and companies stay alive, the accounting and thereby, Tally solutions will deem fit for use.

Tally Prime offers job opportunities for roles like Accountants, Accounts Executives, and Tally Operators in sectors such as finance, manufacturing, and IT, with salaries varying based on experience and location, but generally ranging from ₹1.5 Lakhs to ₹5 Lakhs annually for freshers and potentially exceeding ₹7 Lakhs for experienced professionals in Navi Mumbai and other areas of India.

Tally Accountant / Accounts Executive: Responsible for managing daily accounting operations, including data entry, invoice processing (purchase and sales), bank reconciliation, and TDS/GST compliances using Tally Prime.

Tally Operator: Focuses on tasks like purchase entry, sales entry, generating e-way bills, and maintaining ledgers within the Tally software.

Salaries

Fresher Salaries: Can range from approximately ₹1.2 Lakhs to ₹2.5 Lakhs per year for Tally Accountants.

Experienced Professionals: Salaries can increase significantly with experience, with some roles for experienced professionals offering packages around ₹5 Lakhs to ₹7 Lakhs and upwards.

Location & Company: Salaries vary across different cities and industries. For example, in Mumbai, salaries might be around ₹20K per month for Tally Prime Accountant, but this is a low-confidence average based on limited data.

Proficiency in Tally Prime for financial tasks.

Knowledge of GST and TDS regulations.

Proficiency in MS Excel and other Microsoft Office tools.

Good communication skills and basic accounting principles.

Average Salary For Tally Professionals

| Job Profile | Average Salary (in LPA) |

|---|---|

| Tally Operator | INR 1,80,000 |

| Tax Accountant | INR 5,60,000 |

| Data entry operator | INR 1,92,000 |

| Finance Officer | INR 3,40,950 |

| Bookkeeper | INR 2,40,000 |

| Tally Junior Accountant | INR 1,50,000 |

| Accounting Clerk | INR 2,40,000 |

| Sales Analyst | INR 5,00,000 |

| Business Development Trainee | INR 5,69,000 |

| Business Analyst | INR 8,65,000 |

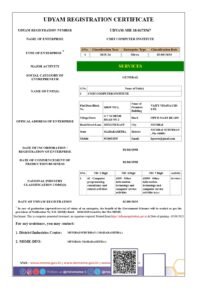

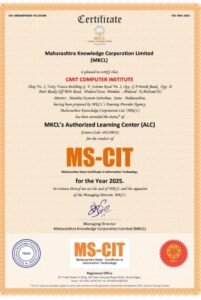

Affiliations / Authorizations

Why Choose CMIT ?

Certified and Experienced Trainers

Weekdays / Weekend Batches Available

Affordable Fees

Small Batch Sizes

Weekly Test Series

Certificate on Course Completion

Free Wi-Fi Facility

Personalized Attention

Certification From Tally Solutions

100% Job Assistance across India for lifetime